Oil Spirals bounces back in Positive after the most ‘Devastating Day’ for Global industry

US oil prices rebounded above zero Tuesday, a day after futures ended in negative territory for the first time as a coronavirus-triggered collapse in demand leaves the world awash in crude.

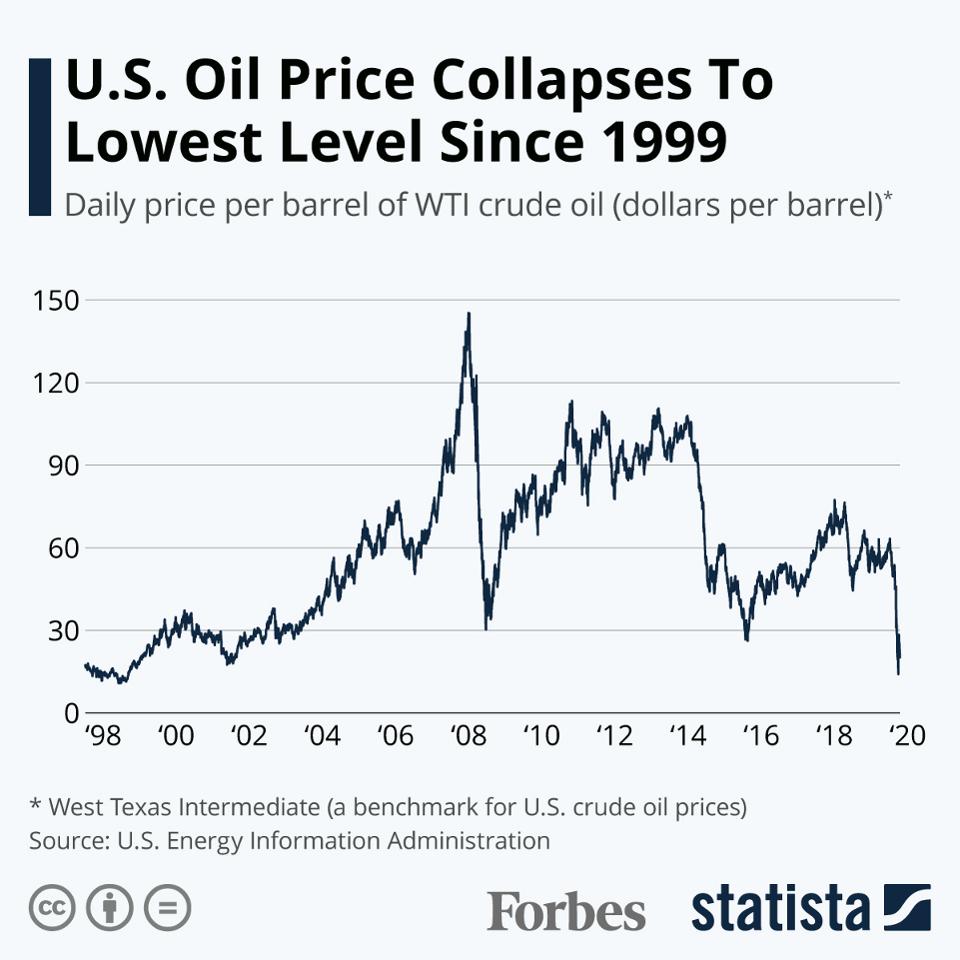

US benchmark West Texas Intermediate for May delivery was changing hands at $1.10 a barrel after closing at -$37.63 in New York.

The May futures contract expires Tuesday, meaning traders who buy and sell the commodity for profit needed to find someone to take physical possession of the oil.

But with the glut in markets and storage facilities full, buyers have been scarce.

Traders are now more focused on the contract for June delivery, which had trading volumes more than 30 times higher. That also rebounded Tuesday, rising to above $21 a barrel following a close of $20.43 a barrel in New York.

Brent crude, the international benchmark, was changing hands at $25.61 a barrel for June delivery, up 0.15 percent.

Oil markets have plunged in recent weeks as lockdowns and travel restrictions to fight the coronavirus around the world batter demand.

The crisis was worsened by a price war between Saudi Arabia and Russia. Riyadh and Moscow drew a line under the dispute and, along with other top producers, struck a deal to cut output by almost 10 million barrels a day earlier this month.

But prices have continued to fall as analysts say the cuts are not enough, and as storage facilities reach capacity.

US crude’s collapse Monday was triggered in part by the closely monitored WTI storage facility at Cushing, Oklahoma filling up, as well as traders closing out their positions before the expiry of the May contract.

“The WTI May futures contract is due to expire on Tuesday, forcing any holders of that contract to accept physical delivery,” ANZ Bank said in a note.

“With storage facilities filling up fast, particularly at the WTI pricing point, Cushing, there are fears that there will be nowhere to store it.”

Michael McCarthy, chief market strategist at CMC Markets, added that “the prospect of having to pay to sell crude oil provided a brutal reminder of the current unusual economic conditions”.

Analysis by Andrew Walker- Economic correspondent

The leading exporters – Opec and allies such as Russia – have already agreed to cut production by a record amount.

In the United States and elsewhere, oil-producing businesses have made commercial decisions to cut output. But still the world has more crude oil than it can use.

And it’s not just about whether we can use it. It’s also about whether we can store it until the lockdowns are eased enough to generate some additional demand for oil products.

Capacity is filling fast on land and at sea. As that process continues it’s likely to bear down further on prices.

It will take a recovery in demand to really turn the market round and that will depend on how the health crisis unfolds.

There will be further supply cuts as private sector producers respond to the low prices, but it’s hard to see that being on a sufficient scale to have a fundamental impact on the market.

For US drivers, the decline in oil prices – which have fallen by about two-thirds since the start of the year – has had an impact at the pumps, albeit not as dramatic as Monday’s decline might suggest.

“The silver lining is, if you for various reason actually need to be on the roads, you’re filling up for far less than you would have been even four months ago,” Mr Glickman said. “The problem for most of us is even if you could fill up, where are you going to go?”

US President Donald Trump has said the government will buy oil for the country’s national reserve. But concern continues to mount that storage facilities in the US will run out of capacity, with stockpiles at Cushing, the main delivery point in the US for oil, rising almost 50% since the start of March, according to ANZ Bank.

Mr Innes said: “It’s a dump at all cost as no one, and I mean no one, wants delivery of oil with Cushing storage facilities filling by the minute.”